California Group Health Insurance

Topics

- California Group Health Insurance for Small Business Employers and Employees

- Quick Overview of the ACA and Small Business Medical Insurance Plans

- Five Things to Know About the ACA and Small Group Medical Insurance

- Advice when Selecting a California Group Health Plan

- Tax Considerations of Group Health Insurance in California

- Specific Small Group Health Plan Information

California Group Health Insurance for Small Business Employers and Employees

Offering medical insurance can help you attract and retain great people. The challenge is that it can be complicated and expensive. The information on this page and others on our website help you understand what’s involved with setting up and maintaining employer-sponsored medical insurance plans that comply with the Affordable Care Act (ACA.

You may find our summary of the Rules for California Small Business Medical Insurance helpful. Here, we answer questions such as:

- what it takes to qualify as a “small business employer”

- what determines the “premium” (which is the polite word insurance companies use instead of “price”)

- how to compare the benefits of one plan with another (e.g., the cost of doctor visits, in-hospital services, prescription medicine co-payments)

- what sort of tax benefits group medical insurance offers employers and employees.

We’ve created easy-to-understand graphics to help you quickly understand what’s going on. At the bottom of this page you’ll find links to informative articles about other aspects of California group medical insurance, such as help selecting the right plan for the best employee health benefits.

Running your small business is hard enough without the confusion that health insurance can cause. We’re here to help. We’re expert benefit advisors and there is no additional charge for our services. The insurance companies pay us, and you pay the exact same rate for medical coverage with the assistance of an agent/broker like us, or if you sign up directly with an insurance company. Better yet, we offer significant added services such as:

- keeping you in compliance with required federal and state laws,

- communicating benefit information to your employees so that they can select and enroll in plans,

- helping you add and terminate employees, and

- making sure that everything works as it should.

Contact us for Group Health Insurance Quotes or give us a call at (800) 746-0045 and we can help.

Quick Overview of the ACA and Small Business Medical Insurance Plans

We’ve written a short summary of the State of California’s guidelines for companies with 1-100 employees. All of the insurance companies (Blue Shield, Anthem, Kaiser, etc.) must follow these rules. Our experience lead us to put together a comprehensive look at the Rules for offering small-business group health insurance in California. We also offer this content as a print-friendly PDF: Rules for California Small Business Health Insurance.

Rules for California Small Business Health Insurance

How to get the Most out of Your PPO Health Plan

Five Things to Know About the ACA and Small Group Medical Insurance

-

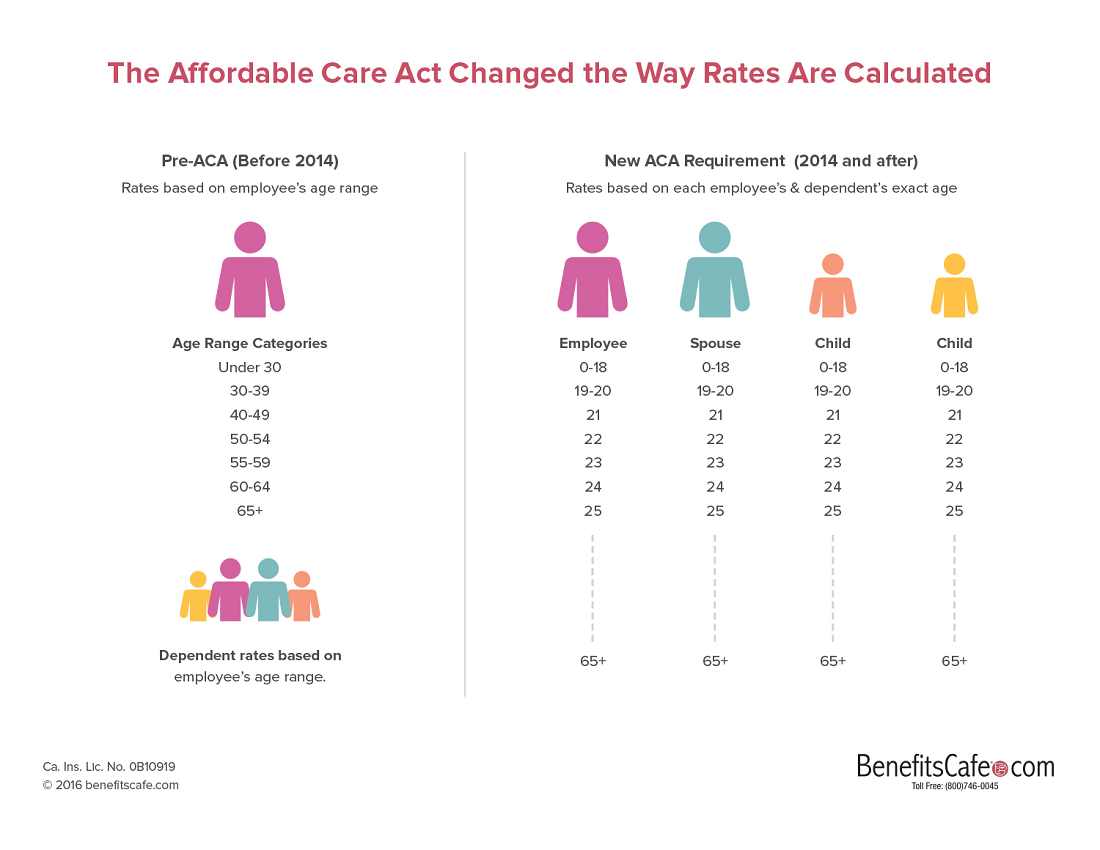

The ACA Changed the Way Insurance Companies Calculate the Rates for Small Group Health Insurance

Before 2014, all small group health plans set rates based on the age range of an employee. So, if an employee’s age fell within a range of less than 30 years old; 30-39, 40-49, etc. then there was one rate for that range. Similarly, it didn’t matter whether the employee’s spouse was young or old, or if the employee had one child or many children. There was a single rate for spouse, children, and family and all were based on the age of the employee. No longer. Now, beginning with 2014 ACA-Compatible plans, the rate for small group health insurance is based on the exact age of an employee and the age of each dependent spouse and child.

Note also that beginning in 2014 the ACA eliminated the consideration of pre-existing medical conditions as a factor for determining the rate. In California this means the elimination of the “RAF” or “Risk Adjustment Factor” which allowed rates to vary plus or minus 10 percent from the standard rate. Now, it doesn’t matter if your employees are running marathons or have one foot in the grave; you get the same rate.

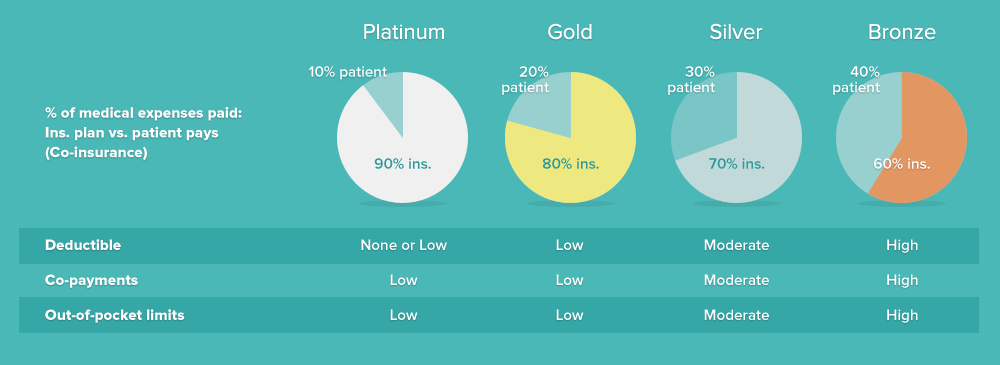

- The ACA Uses Standardized Benefits and “Metallic Levels” to Compare Plan Benefits

Health insurance is complicated (and expensive). To help people understand plan benefits and to enable people to compare one plan with another plan, the Federal government uses a computer model. It determines the percent of charges an insurance plan pays for doctor visits, hospitalizations, and all other benefits of the plan. The result is an “actuarial value” (AV) for the plan. Next the government separates the plans based on the actuarial value and sorts plans into 4 different categories: Platinum, Gold, Silver and Bronze. Just like in the Olympics; Gold is better than Silver which is better than Bronze. A Platinum plan is the best, meaning that the insurance plan pays the most and the patient pays the least for medical services. The insurance company pays 90 percent of medical expenses on Platinum plans while they only pay 60 percent of expenses on Bronze plans The ACA forbids plans that cover less than 60 percent of medical expenses. See this graphic for more info:

The Affordable Care Act Uses Metallic Levels to Compare Plan Benefits

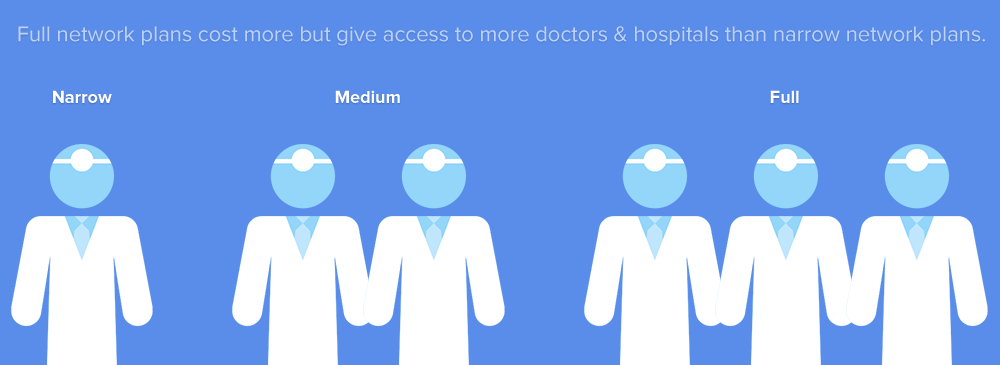

- Insurance Companies Use Doctors & Hospital Provider Networks to Reduce the Cost of Health Plans

The price of medical care varies dramatically between doctors and hospitals (providers). Some charge a little, others charge a lot. Medical insurance plans which include expensive providers cost more than plans that only include moderate or inexpensive doctors, hospitals, laboratories, etc. For example, Ronald Reagan UCLA Medical Center and Cedars-Sinai Medical Center offer world-class services but they are also among the most expensive hospitals in the country. People who live far from the Westside, where these hospitals are located, may never seek treatment there. By enrolling on a medical insurance plan that excludes expensive doctors and medical facilities, employees can obtain comprehensive benefits (e.g., platinum level) at a low cost. (For more information about the cost of medical care, see this article that includes a link to a PBS special about the high cost of care at UCLA).

Narrow to Full Provider Networks

So, when you evaluate a medical insurance plan for your employees, keep in mind that you can offer a “narrow” or “medium” provider network and spend less than if you offer a “full” network. Some insurance companies allow small group employers to offer small, medium and large networks at the same time to employees. Other companies allow only one provider network. Health Net offers two choices: full networks only; or, medium and narrow networks. By working with Benefits Cafe, we can help you match the network to the needs of your employees.

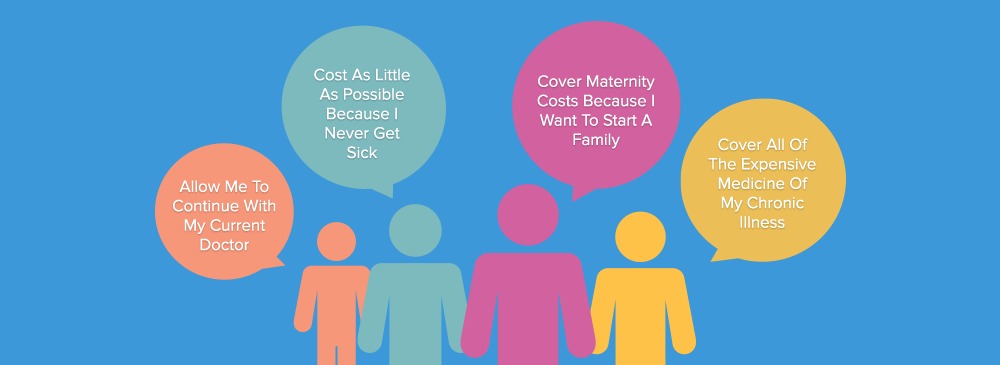

- Small Employers can offer a Wide Range of Group Health Insurance Plans to Meet Employees’ Needs and Budget

Employees differ in their wants and needs for health insurance. Some employees never go to the doctor and only want catastrophic coverage. Others have chronic illnesses such as diabetes, and want a medical plan that covers services with little contribution by them. The good news is that a small employer can offer a wide range of plans to employees: HMO or PPO; Platinum, Gold, Silver or Bronze level of benefits; full, medium or narrow network. An employer can tailor the benefits to meet the company’s needs but also the employees desires. Some employers offer a single plan to all employees. Other companies offer a single HMO and a single PPO plans. Still other companies may offer 3 to 6 different medical plans and allow the employees to select the one that best fits their needs. We’ve found that offering more than 6 or 7 plans gets a bit overwhelming for employees. However, insurance companies allow small employers to offer 20 or more plans to their employees – while controlling the cost to the employer.

What Employees Want from their Employer-sponsored Plans

- Small Employers can Share the Cost of Medical Insurance with Employees

Group medical insurance is extremely tax favored, which is one of the major reasons that companies offer employee benefits. Unlike wages, employer-sponsored health coverage is not subject to FICA, or state and federal income taxation – for the employer or for the employee. (This can be done through a Section 125 plan, which BenefitsCafe.com can assist you with setting up.) So, an employer can share the cost of coverage with the employees. All California health insurance companies require that an employer contribute a minimum of 50 percent of the monthly cost (premium) of an employee-only plan. Most insurance companies also allow an employer to contribute as little as $100/employee/month. The catch is that if an employer pushes too much cost on to the employee, employees won’t sign up and a group plan needs a minimum percent of the employees to be viable.

One popular solution is for an employer to “sponsor” a specific plan, the Silver 1500 HMO Kaiser plan in CalChoice, as an example. When the employer pays 100 percent of the cost of this plan, employees can enroll in that plan or enroll in a lower cost plan and apply the cost savings to a dependent spouse or child’s premium. Employees who may want a PPO or a richer benefit plan can “buy-up” to the better plan and pay the difference through a pre-tax payroll deduction. We at BenefitsCafe.com can assist you with setting this up. Just give us a call at 800-746-0045 or complete this contact form.

What Business Owners Want from their Group Benefits

Advice when Selecting a California Group Health Plan

5 Ways to Spend Less and Give Your Employees More – Employers have hundreds of medical insurance plans. Here are 5 ideas that may help you meet the needs of your employees while also helping to meet your company’s bottom line.

Benefits of using a Small Group Health Insurance Broker – Learn the advantages of using a small group health insurance broker to assist with your group policy. Seeking out an employee-benefits adviser can significantly help, and by California law, is at no additional cost to you.

How to Evaluate a Health Plan – Health care plans can appear to be convoluted to the untrained eye. Learn how we simplify the process of comparing different plans by focusing on three factors: benefits, price, and providers.

Small Group Health Insurance Eligibility – Learn about comprehensive legislation to regulate small business health insurance in California and how to determine an eligible employer/employee and what that entails.

Myth Busters: Employee Participation and Employer Contribution – Small business owners often find it financially difficult to start group health plan for their employees without bankrupting the company. Here we set out to dispel common myths of small group health insurance.

California Small Group Rules protect small businesses that purchase health insurance for their employees. This document describes the rights and obligations of small businesses that purchase coverage for small business health insurance in California.

Tax Considerations of Group Health Insurance in California

Tax Incentives for Group Health, Dental, and Life Insurance – Learn how State and Federal tax treatment of employee benefits provides a valuable incentive to employers to pay for employee health, dental, and life insurance plans.

The Problem with Paying for Insurance through a Salary Bonus – Find out how the strategy of paying employees a salary bonus to purchase their own insurance costs employer and employee a lot of money compared to a California small group health insurance plan.

Specific Small Group Health Plan Information

Learn about the small group plans from Anthem Blue Cross of California, Aetna of California, Blue Shield, Kaiser Permanente and others, and the benefits and drawbacks of these plans in our California small group health plans section.

For those turning 65, read this helpful guide to help determine if you should stay on your employer’s group plan or enroll in a Medicare Supplemental plan.

Need personalized advice? Feel free to give us a call at 1-800-746-0045 and we can help you find the best California small group health plan based on your specific needs and requirements.

How Much Does It Cost to Provide Health Insurance for Employees?

If you’re a small business owner with 1 to 100 employees and you want to calculate the cost of medical insurance for your employees, then you should get a quote and input your company information. Or, you can call Benefits Cafe (800) 746-0045 and we can prepare a custom quote for you.